Getting My Guided Wealth Management To Work

Getting My Guided Wealth Management To Work

Blog Article

What Does Guided Wealth Management Do?

Table of ContentsFascination About Guided Wealth ManagementGuided Wealth Management for BeginnersGuided Wealth Management Can Be Fun For AnyoneThe 8-Second Trick For Guided Wealth ManagementThe Best Guide To Guided Wealth Management

For more suggestions, see monitor your financial investments. For financial investments, pay payable to the item company (not your adviser) (superannuation advice brisbane). Routinely examine transactions if you have a financial investment account or utilize an financial investment system. Offering a financial advisor complete accessibility to your account raises danger. If you see anything that doesn't look right, there are actions you can take.If you're paying a recurring advice charge, your adviser needs to examine your financial circumstance and consult with you at least once a year. At this conference, make certain you review: any adjustments to your goals, scenario or financial resources (consisting of adjustments to your income, costs or properties) whether the degree of risk you're comfortable with has actually altered whether your existing individual insurance cover is ideal just how you're tracking against your objectives whether any modifications to laws or monetary products could impact you whether you have actually gotten everything they guaranteed in your contract with them whether you require any type of modifications to your plan Every year an adviser have to seek your written authorization to bill you recurring suggestions fees.

If you're relocating to a new adviser, you'll need to set up to move your financial records to them. If you require aid, ask your advisor to clarify the process.

The 6-Second Trick For Guided Wealth Management

As an entrepreneur or small service proprietor, you have a whole lot taking place. There are numerous obligations and expenditures in running a business and you absolutely do not require another unneeded expense to pay. You require to very carefully think about the roi of any solutions you get to make certain they are rewarding to you and your company.

If you are among them, you may be taking a significant threat for the future of your business and yourself. You might wish to keep reading for a list of reasons that employing a financial advisor is helpful to you and your service. Running an organization has lots of difficulties.

Cash mismanagement, cash money flow problems, overdue payments, tax problems and various other economic troubles can be important sufficient to close a service down. That's why it's so crucial to control the economic facets of your organization. Working with a credible monetary consultant can prevent your organization from going under. There are several ways that a certified financial expert can be your companion in aiding your organization prosper.

They can deal with you in assessing your financial scenario on a normal basis to avoid serious blunders and to swiftly correct any type of poor cash choices. A lot of small company owners use many hats. It's reasonable that you want to conserve cash by doing some tasks on your own, however dealing with funds takes understanding and training.

Our Guided Wealth Management Diaries

Preparation A company plan is crucial to the success of your business. You need it to know where you're going, exactly how you're obtaining there, and what to do if there are bumps in the roadway. An excellent economic consultant can put with each other a detailed plan to aid you run your service much more effectively and plan for abnormalities that develop.

Wise financial investments are critical to achieving these goals. The majority of business owners either don't have the experience or the time (or both) to assess and evaluate investment opportunities. A credible and knowledgeable monetary consultant can guide you on the financial investments that are best for your organization. Cash Cost savings Although you'll be paying a monetary advisor, the long-term cost savings will certainly validate the price.

Reduced Stress and anxiety As an organization owner, you have great deals of points to worry around. A great economic consultant can bring you peace of mind understanding that your funds are obtaining the focus they require and your cash is being invested sensibly.

An Unbiased View of Guided Wealth Management

Security and Growth A qualified monetary consultant can provide you clarity and help you concentrate on taking your service in the best instructions. They have the devices and resources to utilize methods that will certainly guarantee your company expands and thrives. They can assist you analyze your goals and figure out the most effective path to reach them.

Some Known Incorrect Statements About Guided Wealth Management

At Nolan Audit Center, we provide competence in all aspects of financial preparation for small companies. As a little company ourselves, we understand the difficulties you encounter on a day-to-day basis. Give us a telephone call today to go over how we can help your service thrive and prosper.

Independent ownership of the method Independent control of the AFSL; and Independent remuneration, from the client only, by means of a set buck cost. (https://guides.co/g/guided-wealth-management?ajs_event=Referred)

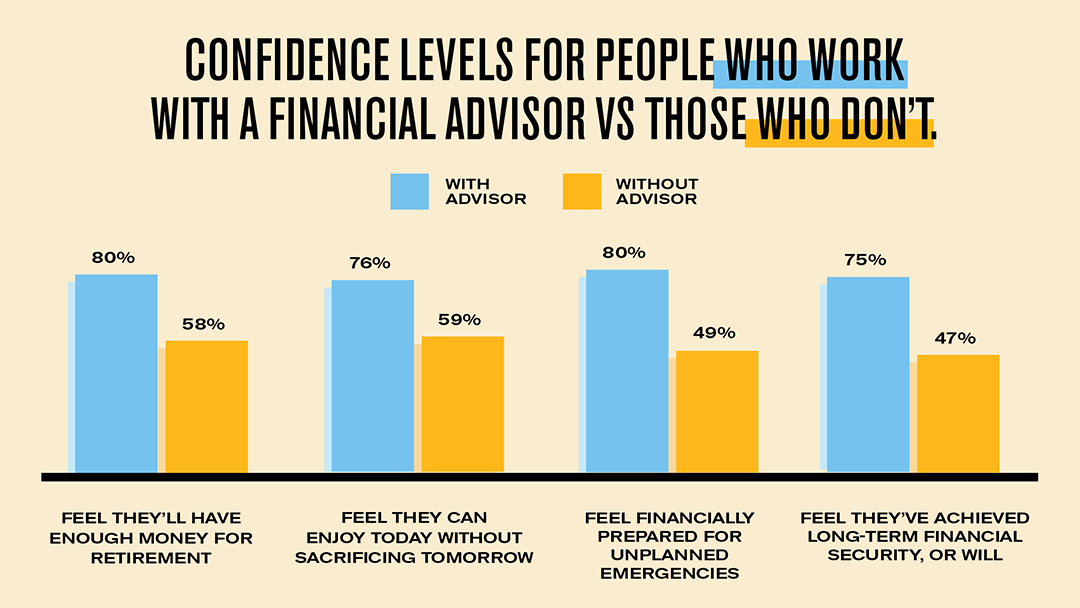

There are countless benefits of a monetary planner, no matter your scenario. But despite this it's not unusual for individuals to 2nd assumption their viability due to their position or present financial investments. The objective of this blog is to confirm why every person can benefit from a monetary strategy. Some usual issues you might have felt on your own include: Whilst it is easy to see why individuals may think this way, it is absolutely not ideal to regard them fix.

Report this page